Pie Insurance is transforming the landscape of workers’ compensation insurance for small businesses with its innovative approach and commitment to simplicity. Founded in 2017, Pie Insurance offers a streamlined, digital platform that enables small businesses to obtain affordable workers’ compensation coverage quickly and efficiently. In this review, we’ll explore the key features, strengths, and weaknesses of Pie Insurance, highlighting how it addresses the unique needs of small businesses and provides a seamless insurance experience.

Overview of Pie Insurance:

Pie Insurance specializes in providing workers’ compensation insurance tailored specifically for small businesses. The company leverages technology and data analytics to simplify the insurance process, offering competitive rates and personalized service to its customers. With a focus on transparency, affordability, and accessibility, Pie Insurance aims to empower small businesses to protect their employees and assets without the complexity and hassle typically associated with traditional insurance providers.

Key Features and Benefits:

- Simplified Quoting Process: Pie Insurance offers a straightforward, user-friendly platform that allows small business owners to obtain workers’ compensation quotes quickly and easily. Through its online application process, users can input basic information about their business and receive customized quotes in minutes, eliminating the need for lengthy paperwork or complicated underwriting procedures.

- Competitive Pricing: Pie Insurance is committed to offering affordable workers’ compensation coverage for small businesses. By leveraging technology to streamline operations and reduce overhead costs, the company is able to provide competitive rates that are often lower than those offered by traditional insurers, enabling small businesses to save money on insurance premiums.

- Customized Coverage Options: Pie Insurance offers flexible coverage options that can be tailored to meet the unique needs of each small business. Policyholders can choose from a range of coverage limits, deductibles, and endorsement options to create a policy that aligns with their specific requirements and budgetary constraints.

- Dedicated Customer Support: Pie Insurance prides itself on delivering exceptional customer service and support to its policyholders. The company’s team of insurance experts is available to assist small business owners with any questions or concerns they may have, providing personalized guidance and assistance throughout the insurance process.

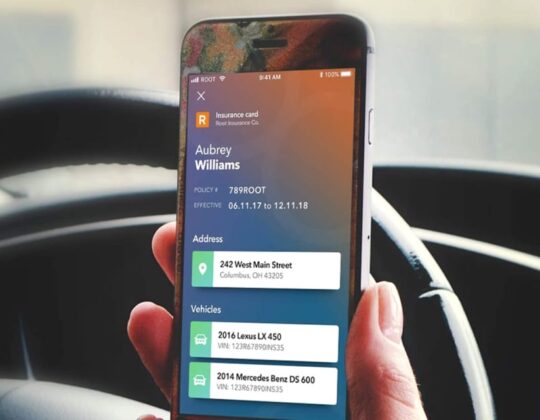

- Digital Claims Handling: Pie Insurance offers a seamless claims handling process through its online platform. Policyholders can report claims electronically, track the status of their claims in real-time, and communicate directly with claims adjusters, ensuring a quick and efficient resolution to any workplace incidents or injuries.

Strengths of Pie Insurance:

- Focus on Small Businesses: Pie Insurance caters specifically to the needs of small businesses, providing tailored workers’ compensation solutions that address their unique challenges and requirements. The company’s specialized approach and dedication to serving small businesses set it apart from traditional insurers that may offer one-size-fits-all policies.

- Technology-Driven Solutions: Pie Insurance leverages technology and data analytics to streamline the insurance process and deliver a superior customer experience. The company’s digital platform simplifies quoting, policy management, and claims handling, enabling small business owners to access insurance coverage quickly and efficiently.

- Affordability and Transparency: Pie Insurance is committed to offering transparent pricing and competitive rates for its workers’ compensation coverage. By eliminating hidden fees and unnecessary bureaucracy, the company provides small businesses with affordable insurance options that fit within their budgets.

- Ease of Use: Pie Insurance’s user-friendly platform makes it easy for small business owners to navigate the insurance process with minimal hassle. The online application, quoting, and policy management tools are designed to be intuitive and accessible, allowing users to obtain coverage with just a few clicks.

Weaknesses of Pie Insurance:

- Limited Availability: As a relatively new player in the insurance industry, Pie Insurance may have limited availability in certain geographic regions. Small businesses operating outside of Pie Insurance’s coverage area may not be able to take advantage of its services, limiting its accessibility to some potential customers.

- Coverage Limitations: While Pie Insurance offers customizable coverage options, some small businesses may find that certain industry-specific risks or requirements are not adequately addressed by its standard policies. Businesses with unique needs or specialized operations may require additional endorsements or coverage enhancements that are not readily available through Pie Insurance.

Conclusion:

Pie Insurance is redefining workers’ compensation insurance for small businesses with its simplified approach, competitive pricing, and dedication to customer service. By leveraging technology and data analytics, the company has streamlined the insurance process, making it easier and more affordable for small business owners to protect their employees and assets. While Pie Insurance may have limitations in terms of availability and coverage options, its strengths in affordability, transparency, and customer-centricity make it a compelling choice for small businesses seeking reliable workers’ compensation coverage. Overall, Pie Insurance represents a promising solution for small business owners looking to mitigate risk and ensure compliance with workers’ compensation requirements.