Progressive Insurance stands as one of the largest and most recognizable names in the insurance industry, renowned for its commitment to innovation, comprehensive coverage options, and reliable customer service. With over eight decades of experience, Progressive has evolved into a market leader, offering a wide range of insurance products to meet the diverse needs of consumers. In this review, we’ll delve into the key features, strengths, and weaknesses of Progressive Insurance, exploring how it has earned its reputation as a trusted provider in the competitive insurance landscape.

Overview of Progressive Insurance:

Founded in 1937, Progressive has continually embraced innovation to stay ahead of the curve in an ever-evolving industry. Initially focusing on auto insurance, the company has since expanded its offerings to include home, renters, motorcycle, boat, RV, and commercial insurance, among others. Progressive is widely recognized for its competitive rates, customizable coverage options, and user-friendly digital platform, which allows customers to manage their policies conveniently. With a strong emphasis on customer satisfaction and technological advancements, Progressive has become a household name synonymous with reliability and trust.

Key Features and Benefits:

- Comprehensive Coverage Options: Progressive offers a wide array of insurance products tailored to meet the needs of individuals, families, and businesses. Whether it’s auto, home, renters, or specialty insurance, Progressive provides customizable coverage options to suit various lifestyles and budgets.

- Innovative Snapshot Program: Progressive’s Snapshot program utilizes telematics technology to monitor customers’ driving habits and adjust their auto insurance premiums accordingly. By rewarding safe driving behavior, such as maintaining a steady speed and avoiding sudden stops, Snapshot enables customers to potentially lower their insurance costs based on their actual driving performance.

- Bundling Discounts: Progressive offers discounts to customers who bundle multiple insurance policies, such as auto and home insurance. Bundling not only simplifies the insurance process by consolidating policies under one provider but also allows customers to save money through discounted rates and additional perks.

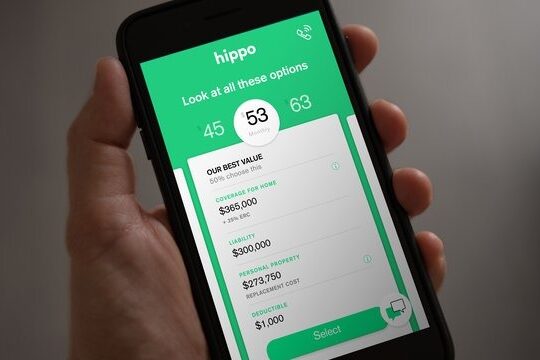

- Name Your Price Tool: Progressive’s Name Your Price tool empowers customers to find an insurance policy that fits within their budget. By inputting their desired coverage and budgetary constraints, customers can receive personalized quotes tailored to their specific needs, enabling them to make informed decisions about their insurance coverage.

- 24/7 Claims Support: Progressive provides round-the-clock claims support to assist customers in times of need. Whether it’s a minor fender-bender or a major disaster, Progressive’s claims representatives are available 24/7 to guide customers through the claims process, offer support, and facilitate prompt resolution.

Strengths of Progressive Insurance:

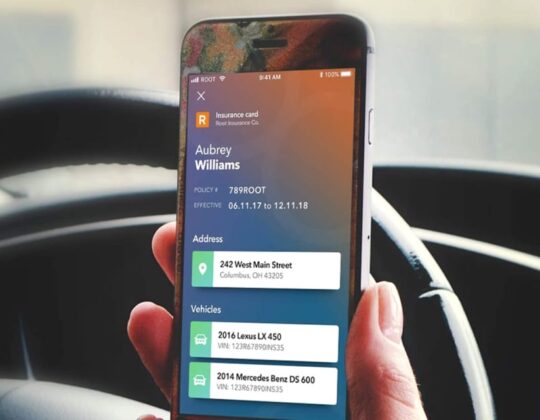

- Innovation and Technology: Progressive has a long history of embracing innovation and leveraging technology to enhance its products and services. From telematics-based insurance programs to user-friendly mobile apps, Progressive continues to invest in cutting-edge solutions that simplify the insurance experience for customers.

- Competitive Rates: Progressive is known for offering competitive rates and discounts to its customers. Whether it’s through bundling policies, participating in the Snapshot program, or taking advantage of various discounts, Progressive provides opportunities for customers to save money on their insurance premiums.

- Customizable Coverage: Progressive understands that one size does not fit all when it comes to insurance. With its customizable coverage options and flexible policy features, Progressive allows customers to tailor their insurance policies to meet their specific needs and preferences.

- Strong Financial Stability: Progressive boasts strong financial stability and a solid reputation in the insurance industry. With its proven track record of financial strength and stability, Progressive provides customers with peace of mind knowing that their insurance provider is well-equipped to handle their claims and obligations.

Weaknesses of Progressive Insurance:

- Limited Availability: While Progressive operates in most states across the U.S., its coverage may be limited in certain regions. Customers residing in areas where Progressive does not offer insurance coverage may need to explore alternative providers, limiting their options.

- Customer Complaints: Like any large insurance company, Progressive has received its share of customer complaints and negative reviews. While the company strives to provide excellent customer service, some customers may experience issues with claims processing, billing, or communication, leading to dissatisfaction.

Conclusion:

Progressive Insurance has established itself as a leading provider in the insurance industry, offering innovative products, competitive rates, and reliable customer service. With its comprehensive coverage options, customizable policies, and commitment to technological advancements, Progressive continues to meet the diverse needs of its customers. While the company may have limitations in terms of availability and occasional customer complaints, its strengths in innovation, affordability, and financial stability position it as a top choice for consumers seeking trustworthy insurance coverage. Overall, Progressive Insurance exemplifies excellence in the insurance industry, delivering value, reliability, and peace of mind to millions of customers nationwide.