In the realm of home insurance, Hippo Insurance has emerged as a disruptor, combining technology, data analytics, and a customer-centric approach to revolutionize the traditional insurance model. Founded in 2015, Hippo offers homeowners insurance policies designed to meet the needs of modern homeowners while prioritizing simplicity, transparency, and affordability. In this review, we’ll explore the key features, strengths, and weaknesses of Hippo Insurance, shedding light on what sets it apart in the competitive home insurance market.

Overview of Hippo Insurance:

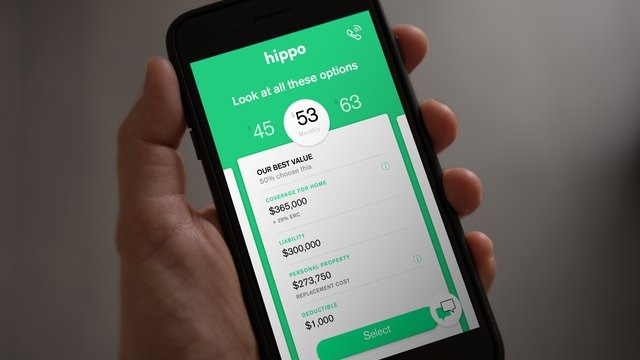

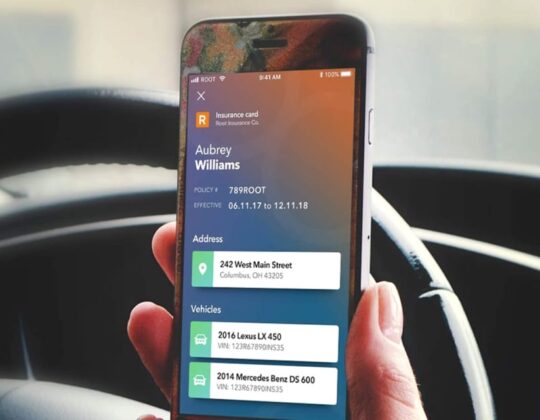

Hippo Insurance is a digital home insurance company that leverages technology and data-driven insights to provide personalized coverage solutions for homeowners. The company offers a range of homeowners insurance policies designed to protect against common risks such as property damage, theft, liability, and more. Through its online platform and mobile app, Hippo aims to simplify the insurance process, enhance the customer experience, and deliver value-added services that meet the evolving needs of homeowners.

Key Features and Benefits:

- Modernized Coverage Options: Hippo’s homeowners insurance policies are tailored to the needs of modern homeowners, offering comprehensive coverage for dwellings, personal property, liability, and additional living expenses. The company’s policies are designed to protect against a wide range of risks, including fire, theft, vandalism, water damage, and natural disasters.

- Technology-Driven Underwriting: Hippo utilizes advanced technology and data analytics to streamline the underwriting process and assess risk more accurately. By leveraging data from various sources, including property records, satellite imagery, and smart home devices, Hippo can offer personalized premiums that reflect each homeowner’s unique risk profile.

- Smart Home Discounts: Hippo offers discounts to homeowners who have installed smart home devices such as security cameras, smoke detectors, and water leak sensors. These devices not only enhance home security and safety but also provide valuable data that can help Hippo assess risk and prevent potential losses.

- Seamless Claims Experience: Hippo’s claims process is designed to be fast, transparent, and hassle-free. Policyholders can file claims online or through the mobile app, track the progress of their claims in real-time, and receive prompt assistance from Hippo’s dedicated claims team. The company’s focus on technology and automation ensures that claims are processed efficiently, minimizing inconvenience for homeowners.

- Value-Added Services: In addition to traditional insurance coverage, Hippo offers value-added services such as home maintenance reminders, home repair assistance, and identity theft protection. These services complement Hippo’s insurance offerings and provide homeowners with added peace of mind and convenience.

Strengths of Hippo Insurance:

- Technological Innovation: Hippo’s use of technology and data analytics sets it apart from traditional insurers, enabling the company to offer personalized coverage, streamline processes, and enhance the overall customer experience. By harnessing the power of technology, Hippo can adapt quickly to changing market dynamics and customer preferences, driving innovation and differentiation.

- Customer-Centric Approach: Hippo prioritizes the needs and preferences of homeowners, offering tailored insurance solutions, transparent pricing, and value-added services that add tangible benefits for policyholders. The company’s commitment to customer satisfaction and engagement fosters trust and loyalty among its customer base.

- Comprehensive Coverage: Hippo’s homeowners insurance policies provide comprehensive coverage for a wide range of risks, ensuring that homeowners are adequately protected against potential losses. The company’s focus on modernizing coverage options and addressing emerging risks reflects its commitment to meeting the evolving needs of homeowners.

- Smart Home Integration: Hippo’s emphasis on smart home technology not only enhances home security and safety but also enables the company to offer discounts and incentives to homeowners who invest in these devices. By promoting smart home integration, Hippo encourages proactive risk management and loss prevention, ultimately benefiting both homeowners and insurers.

Weaknesses of Hippo Insurance:

- Limited Availability: Hippo’s homeowners insurance coverage may not be available in all states or regions, limiting its accessibility to homeowners in certain geographic areas. While the company continues to expand its footprint, availability constraints may pose challenges for homeowners seeking coverage.

- Lack of Personalized Advice: Despite Hippo’s focus on technology and automation, some homeowners may prefer personalized advice and guidance when navigating insurance decisions or coverage options. The company’s digital-first approach may lack the human touch and individualized support that some customers seek.

Conclusion:

Hippo Insurance has emerged as a game-changer in the home insurance industry, leveraging technology, data analytics, and a customer-centric approach to deliver modernized coverage solutions for homeowners. By harnessing the power of technology to streamline processes, personalize premiums, and enhance the customer experience, Hippo has positioned itself as a leader in the digital insurance space. While availability constraints and the lack of personalized advice may pose challenges for some homeowners, Hippo’s strengths in technological innovation, comprehensive coverage, and smart home integration make it a compelling choice for modern homeowners seeking reliable, affordable, and user-friendly insurance solutions. Overall, Hippo Insurance represents a promising evolution in the home insurance market, offering a fresh perspective and driving positive change for homeowners nationwide.